Posted by Dmytro Dodenko

The Architecture of Trust: How to Build Financial Models Trusted by Investors and the Board of Directors

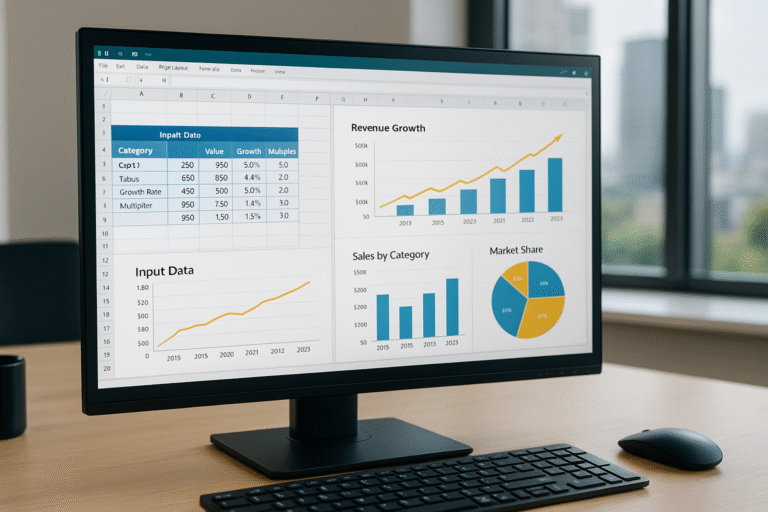

When I look at any business, I see it through the lens of a model. It is the model that allows us to transform assumptions into concrete numbers, rapidly test scenarios, and demonstrate where the risk lies and where the opportunity exists.

Creating a financial model is not about mastering complex functions. It is a discipline, a philosophy, and, without exaggeration, an art. It is a process that requires strategic thinking far more than technical virtuosity. As stated in the FAST Standard:

“Financial models must be as simple as possible, but not simpler. Any model that is excessively complex is not a good model. Without simplicity, supported by rigorous structure, a financial model will be poorly suited for its sole purpose—supporting informed business decisions.”

In this article, I synthesize my own working principles and show how to combine practical experience with recognized standards—the FAST Standard, the ICAEW Financial Modelling Code, and the “Twenty Principles.” Ultimately, these standards and recommendations are grounded in common sense.

Stage 1: Strategy and Architecture. Laying the Foundation Before the First Formula

Any construction project begins with a detailed blueprint, not with buying bricks. The same applies to modeling. Before opening the software, answer key questions:

- What is the goal of the model? This is the most critical question. Are we building a model to attract investment, for internal budgeting, or to evaluate a new project? The answer determines the level of detail, key takeaways, and the audience. A model for internal discussion with the operations team differs radically from a model for the Board of Directors or external investors. A model without a clear goal is just a collection of numbers.

- Is a spreadsheet the best tool? An experienced specialist knows the limits of their tools. For processing huge arrays of uniform data, a database is more suitable, and for standard processes like bookkeeping, specialized software is better. Do not try to build a spaceship with a hammer.

- Which methodology do we follow? Implementing a unified standard, such as FAST (Flexible, Appropriate, Structured, Transparent), is a sign of a mature organization. This does not restrict but rather simplifies collaboration, the transfer of the model to other specialists, and significantly reduces risks. The model must be flexible (easy to change assumptions), appropriate (without excessive detail), structured, and transparent—this is what is embedded in the FAST acronym.

Stage 2: Design and Build. Creating for Flexibility and Transparency

Imagine that your model is a car. The model must be convenient for the user (the “driver”) and understandable for the person who will check or modify it (the “mechanic”).

- Clear structure is the key to success. The Golden Rule: Inputs → Calculations → Results → Checks. These blocks must be clearly separated. Inputs are entered only once, in one place. This eliminates confusion and errors during updates.

In an ideal model, separate sheets should be dedicated to:- Inputs: All assumptions that can change.

- Timing: Calculation of flags (binary switches) that determine when events occur, inflation indices, etc.

- Workings/Calcs: The main “engine” of the model, divided by functional blocks (Revenue, OpEx, Financing, Tax).

- Outputs: Financial statements (P&L, Balance Sheet, Cash Flow), charts, and key metrics.

- Checks: A sheet where all model checks are aggregated. It is also important to adhere to a unified column structure and timeline across all sheets where possible. This significantly facilitates navigation and analysis.

- Transparency, Not a “Black Box”. The model must be understandable even for a non-modeler.

- The “Calculation Block” Concept: This is a key principle of the FAST standard. Instead of having links to different sheets within a formula, all “ingredients” (precedents) for the calculation are first gathered in one place, directly above the formula itself. This makes the logic absolutely transparent and easy to audit.

- Simple and Consistent Formulas: Break down complex calculations into several stages. Avoid long formulas (a rule of thumb). Avoid macros where possible, as they complicate verification and maintenance by non-specialists.

- Calculate Once, Reference Always. Avoid repeating the same calculations in multiple places. Perform the calculation once, then refer to it in larger and more complex formulas.

- Avoid Dangerous Functions: Nested IFs are evil; they are hard to check and often hide errors. The OFFSET and INDIRECT functions are “volatile” and make the model logic opaque for standard audit tools.

- No Hidden Elements: This rule has no exceptions. Hidden rows, columns, or white font on a white background are signs of bad practice and an attempt to “mask” something. Everything that affects the result must be visible.

- No Fixed Values in Formulas (“Hardcoding”): Move all variables (tax rates, inflation, interest) to separate cells for input data. Embedding such values in formulas means creating problems for yourself in the future.

- Flexibility and Longevity. The model must be ready for changes. Design the architecture so that adding new periods or data does not require rebuilding all formulas. Use dynamic ranges.

Stage 3: Control and Management. Built-in Immunity to Errors

- Built-in Checks: A reliable model signals problems itself. Build in checks from the very beginning. Do not limit yourself to checking the Balance Sheet. Create cross-checks (e.g., the sum of revenues by region must equal the sum of revenues by product). Implement business alerts (warnings about breaches of control values, such as cash flow dropping below a certain level). All these checks must be consolidated into a single “Master Check”—an integral indicator on every sheet that instantly signals any errors in the model. If it shows “ERROR,” you cannot work with the model until the problem is fixed.

- The Review Process is Not a Formality. Simply “looking” at the model is insufficient. A high-quality review includes several stages:

- Structural Review: Is the model built logically?

- Data Review: Are the input data correct, and do they match the sources?

- Analytical Review: Do the results look reasonable? Conduct stress testing by changing key assumptions and observing the model’s reaction.

- Detailed Review: An audit of logical chains and cell-by-cell testing of formulas. For critically important business models, it is advisable to engage an independent expert for verification.

- Documentation and Version Control: The model must outlive its author. Always create a sheet with instructions, a description of logic, and assumptions. Maintain a change log and ensure clear version control. This is critically important for models with a long life cycle.

Conclusion: The Model as a Foundation of Trust

Ultimately, first-class financial modeling is not about how complex the Excel functions you know are. It is about discipline, foresight, and a deep understanding of risk.

A reliable, transparent, and flexible model is not just a file on a server. It is a powerful tool for making informed strategic decisions. It gives confidence to you, your team, the Board of Directors, and investors. Conversely, a failed model is a ticking time bomb.

Implementing these principles in your company is not an additional expense—it is a fundamental step toward building trust. Trust in numbers, trust in decisions, and ultimately, trust in your business. Do not settle for less.

Before diving into formulas, it is important to understand the philosophy of planning. I wrote about why a plan without a model is just a wish list in the article: Plan = Model. If Not, It’s Just a Wish List.

This article was prepared using global best practices outlined in publications by the Institute of Chartered Accountants in England and Wales (ICAEW) and the FAST Standard (FAST Standard Organisation).