Posted by Dmytro Dodenko

Two Perspectives on Budgeting

In the business environment, there are two polar views on budgeting.

The first is a “bureaucratic nightmare.”

From one business group owner, I heard: “The Budget is a law that is mandatory for execution. A step to the left, a step to the right – execution.” By the way, the business of that owner who tried to manage through rigid restrictions ceased to exist long ago.

The second approach, which I advocate and which is the standard for effective CFOs: The Budget is not shackles; it is a digital model of your business. It is a tool that allows you to “live through” the coming year virtually, make mistakes on paper (in Excel) rather than with real money, and understand what resources are needed to achieve goals.

Today, we will talk about how to build a budgeting system that doesn’t just control costs but helps earn money.

Why Budgeting Should Not Be Delegated to Accounting

There is a dangerous illusion that the budget is a “finance matter.” Owners often say: “Let accounting draw something up.” This is a fundamental mistake. Accounting and Budgeting are two different galaxies with opposite philosophies.

- Accounting is a “backward look” (Fact). As experienced auditors aptly say: “Accounting keeps ‘post-mortem’ records.” Its task is to scrupulously, like a pathologist, record what has already happened, according to rigid standards. An accountant has no right to “creativity” or assumptions.

- Budgeting is Architecture and Crash-Testing (Plan). First, we act as architects: we design the future structure of the business, calculating load-bearing capacities and necessary resources. Then we subject this model to a “virtual crash test”: we test hypotheses, model market storms and cash gaps. The goal is simple: it is better to crash the model in Excel than to crash the real company against the market.

When you force an accountant to plan, you get a “certificate of the past” rather than a tool for building and protecting the business.

Budgeting is a Team Game: Role Distribution

A high-quality budget is the result of the joint work of the entire team, where everyone plays a clear role. It is not a solo performance, but a coordinated orchestra:

- CEO / Shareholders (Customers). They set the strategic vector (“Where are we going?”). The budget process does not start with numbers; it starts with strategic goals: “We want to grow by 20%,” “We are entering the Polish market,” or “We are cutting costs.” They also finally approve the overall plan.

- Chief Financial Officer (CFO) (Architect, Strategist, and Chief Engineer). Manages the process, converts strategy into a financial model, and conducts those “crash tests.” He is responsible for turning departmental “wish lists” into a balanced financial strategy. The CFO guarantees that the budget is realistic and the financial model is holistic.

- Finance (or Planning and Economic) Department (Organizers). These are the “moderators” of the process. They develop and control the methodology and budget forms, collect data from units into a single system, and check the mathematics.

- Heads of Departments and Divisions (Plan Authors). It is they who fill the budget with content. The production manager knows raw material consumption norms better, and the commercial director knows market potential. They submit plans in quantitative and monetary terms and defend them before the CFO.

- Controlling Department (Analysts). If this function is separated, controllers handle plan-fact analysis. Their task is not just to state deviations, but to find their causes (Variance Analysis) and signal management.

- Accounting (Fact Provider). Although accounting does not plan, its role is critical: it keeps records of the accomplished fact. Plan-fact analysis is built on the basis of correct accounting data. Without an accurate “yesterday,” it is impossible to analyze “tomorrow.”

Only with such interaction does the budget become a real management tool, and not just a spreadsheet that is forgotten the day after approval.

The Architecture of Financial Success: The Master Budget

Many companies implement budgeting in fragments: controlling only costs or monitoring accounts receivable, but failing to see the big picture. It’s like driving a car while watching only the fuel gauge, ignoring the speedometer and the map.

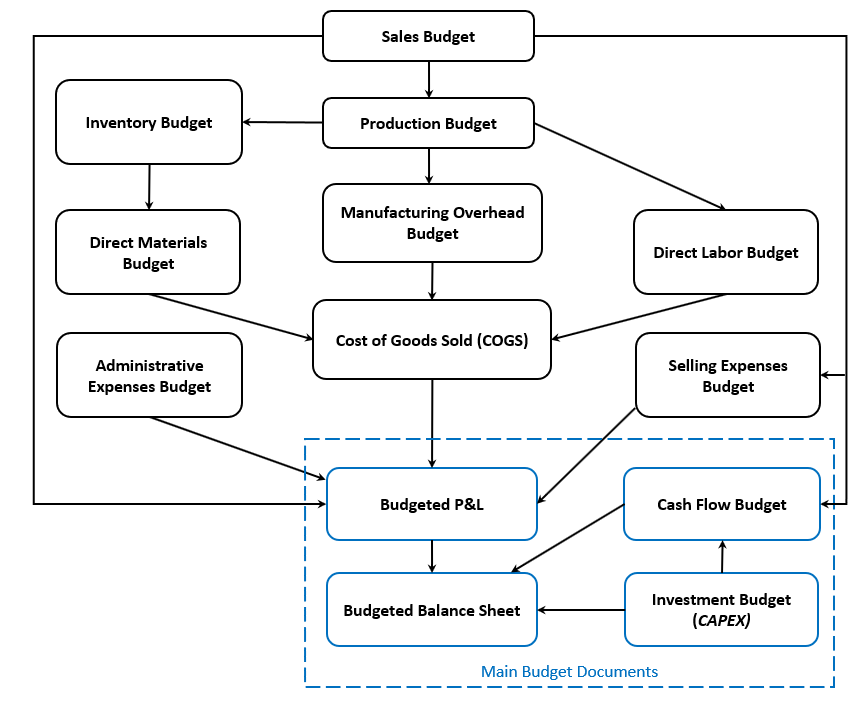

A complete system is the Master Budget, which consists of three fundamental blocks:

1. Operating Budgets (The Business Engine)

They link physical units (pieces, kilograms, man-hours) with money. This is the most massive block, occupying the major part of our scheme. It includes all functional plans seen at the top of the diagram: Sales Budget, Production Budget, Inventory Budget, Direct Cost Budgets (materials, labor), and Overhead Budgets (manufacturing, administrative, commercial). These “bricks” form the Cost of Goods Sold (COGS) and Operating Profit.

2. Investment Budget (Development)

This is the Capital Expenditure plan (CAPEX). Purchasing equipment, constructing new facilities, implementing an ERP system. This budget is based on the company’s long-term strategy. The scheme shows how this budget affects the finale: it requires payments (impact on Cash Flow) and increases the value of company assets (impact on the Balance Sheet).

3. Financial Budgets (The Dashboard)

This is the top of the pyramid that consolidates operating and investment plans. This is exactly where shareholders and banks look. It includes three main reporting forms:

- Budgeted Income Statement (P&L): Shows the efficiency of operating activities (profit).

- Cash Flow Budget: Guarantees solvency. It considers payment schedules and shows whether we will face a cash gap.

- Budgeted Balance Sheet: A “snapshot” of the company’s financial state at the end of the year.

The Logic of Construction: Why Does Everything Start with the Market?

The hierarchy is clearly visible on the budgeting flowchart:

- The Market Dictates Terms. The process always starts with the Sales Budget. This is the foundation. An error here multiplies throughout the entire system. Therefore, the role of the marketing and sales department is critical: they must provide not just “wish lists,” but a grounded forecast of prices and volumes.

- Production Adjusts. The Production Budget is formed based on the sales plan. We produce what we can sell (taking into account inventory levels).

- Resources Follow. Next, the system unfolds into costs: raw materials, wages, energy carriers.

Only when we have consolidated all operating plans do we receive the financial result — the Budgeted P&L and Balance Sheet.

Conclusion

Budgeting is not about limiting costs. It is about the conscious management of the future. If your company uses the budget only for “plan/fact” cost control, you are using a computer merely as a calculator.

The real power of budgeting (especially in conditions of uncertainty) lies in scenario modeling. By changing input parameters (price, exchange rates, raw material costs) in your budget model, you can see the business’s vulnerabilities even before a real crisis hits.