Posted by Dmytro Dodenko

Introduction

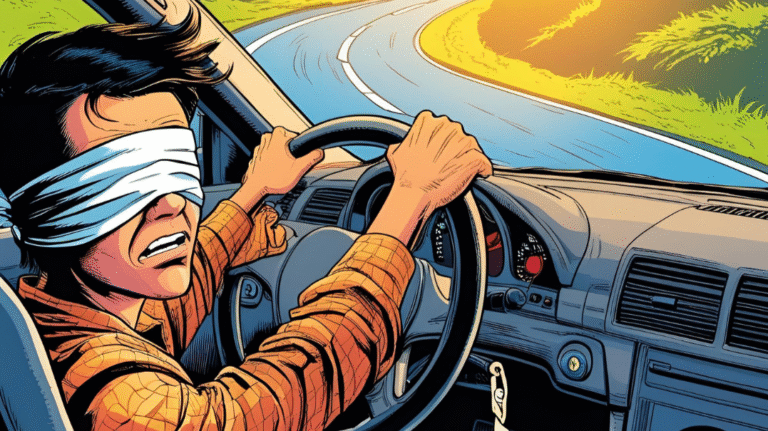

Managing a business without understanding the Balance Sheet is like driving a car blindfolded. You might drive aimlessly for a while, but sooner or later, you will run into trouble.

Many believe that the Income Statement (Profit and Loss, P&L) and the Cash Flow Statement (CF) are sufficient for management. However, analyzing a company’s activity based only on these reports, without considering the Balance Sheet (Statement of Financial Position), is like a doctor making a diagnosis by checking only the pulse, blood pressure, and breathing, but refusing to take an X-ray or MRI.

The Balance Sheet (Statement of Financial Position) is a report that reflects the financial state of an enterprise at a specific date. How can you reach your destination if you don’t know where you are right now?

Let’s imagine a scenario:

You are a new company executive. The business is running, products are selling, there is cash in the account. You finished the year with a net profit of €1 million. Is this a good result?

- For an enterprise with assets of €100,000, probably yes.

- But if this is an enterprise with assets of €1 billion – will the owners be satisfied with such a result?

And a day later, you learn that a key supplier has sued you because you failed to pay a debt of €10 million on time. The court rules in their favor, and your company’s accounts are frozen because there are insufficient funds for collection.

Yet, according to the P&L and CF reports, everything seemed fine…

The Indispensable Role of the Balance Sheet in Managerial Decision-Making

The Balance Sheet is not just a set of boring rows. It is the “X-ray” of the business. Based on Balance Sheet data, ratios are calculated to help assess the company’s financial health.

1. Liquidity Ratios (Solvency)

These reflect the company’s ability to timely settle short-term obligations (Current Liabilities). They are calculated as the ratio of current assets to current liabilities. We distinguish between Current, Quick, and Absolute liquidity ratios. The size of Net Working Capital (current assets minus current liabilities) is also critical for control.

2. Efficiency Ratios (Activity Ratios)

These reflect the efficiency of asset utilization – the speed at which the company earns money.

These are Profitability Ratios (and Returns)* for Assets and Equity and Turnover Ratios (Current Assets, Inventory/Stock, Accounts Receivable/ Debtors, Accounts Payable/ Creditors). With the same profit margin on sales, the Return on Assets (ROA) will be higher for the company with higher asset turnover.

* Note: Profitability is typically calculated as the ratio of profit to a specific resource indicator (e.g., assets). Return (or Total Return) is a broader economic indicator that may include not only net profit but also, for instance, asset appreciation (increase in value).

3. Financial Stability Ratios (Leverage/ Gearing)

These characterize the share of equity and dependence on borrowed funds (debt). These metrics reflect the capital structure. They include indicators such as the Equity Ratio (Financial Independence Ratio), Financial Leverage Ratio, etc.

4. Asset Structure and Property Ratios

These allow assessing the composition and quality of assets. This includes the ratio of Current to Non-current assets, as well as the share of inventory within current assets, the share of overdue accounts receivable, etc.

The Balance Sheet: A Strategic Tool for Effective Capital Management

In modern financial management, Working Capital Management is a pivotal factor determining not only current liquidity but also long-term strategic stability and business profitability.

Working Capital Management Strategies

Working Capital Management is a dynamic process requiring deep analysis and constant optimization. I divide it into two main policies, each having a direct impact on the financial result and risk level:

1. Working Capital Investment Policy

This policy determines the optimal volume of current assets necessary for the enterprise to conduct efficient operations compared to competitors.

Excessive investment in working capital (e.g., surplus inventory, large accounts receivable, or excess cash) leads to frozen funds and loss of potential profit (opportunity costs). On the other hand, insufficient investment can cause product shortages, loss of clients, or liquidity problems.

Formula: Reducing total assets (working capital) while maintaining the level of activity = Increasing Return on Assets (ROA).

My goal is to find the “golden mean” (sweet spot) that ensures an increase in ROA while guaranteeing the company’s uninterrupted operation.

Benefits of Optimizing Working Capital Investment:

| Components | Benefits of Increasing Investment (High Level) | Benefits of Decreasing Investment (Low Level) | My Role in Balancing |

| Inventory | Avoidance of stockouts, volume discounts (on purchase), reduction of ordering costs. | Freeing up cash, lower holding costs, flexibility in updating the assortment. | Developing an inventory management system that minimizes holding costs and shortage risks. |

| Accounts Receivable (Debtors) | Increased sales volume, customer loyalty. | Freeing up cash, reducing bad debt risk, reducing credit control costs. | Implementing an effective credit policy and receivables control system. |

| Cash | Liquidity (timely settlements with creditors). | Avoidance of debt servicing costs, freeing up cash for other investments. | Ensuring an optimal level of liquidity and effective cash flow management. |

| Accounts Payable (Creditors) | Preserving cash (cheap source of financing). | Discounts for early payment, good credit rating, supplier loyalty. | Optimizing settlement terms to maximize financial benefits. |

Strategic Approaches to Investment:

- Aggressive Approach: Characterized by lower volumes of investment in working capital (and lower cash balances) compared to competitors. It ensures higher profitability but is riskier due to potential resource shortages.

- Conservative Approach: Conversely, implies larger volumes of working capital. It ensures lower profitability but carries less risk, providing a larger “safety cushion.”

My Role: The choice between these approaches depends on the company’s strategic goals, its industry, management’s risk tolerance, and the current market situation. As a CFO, I help define the most appropriate strategy and adapt it to changing conditions.

2. Working Capital Financing Policy

This policy is defined by the mix of long-term and short-term financing sources. It has a direct impact on the cost of capital, financial stability, and refinancing risks.

The choice between long-term and short-term sources for financing working capital is determined by:

- The Ratio of Permanent and Fluctuating Current Assets: Fluctuating assets (e.g., seasonal inventory) can be financed by short-term loans, whereas the permanent portion of working capital (minimum required inventory and accounts receivable) requires long-term financing.

- Cost and Risk of Short-Term Financing: Although short-term loans are often cheaper, they carry higher risks of refinancing and interest rate volatility.

- Management’s Risk Appetite: An Aggressive Policy (a higher share of short-term financing) ensures higher profitability but also higher risk. A Conservative Policy (a higher share of long-term financing) offers stability at the cost of profitability. A Moderate (Matching) Policy strives for balance by aligning the maturities of resources and assets.

The main goal of Working Capital Management is not just controlling numbers, but finding the optimal trade-off between liquidity and profitability. This is achieved through a deep understanding of the structure of current assets and liabilities, where Net Working Capital (NWC) is a key indicator reflecting the extent to which current assets are financed by long-term sources.

My goal is to turn this trade-off into a strategic advantage that ensures financial strength and potential for your business growth.

Choosing Enterprise Financing Sources

Selecting optimal financing sources is a strategic decision that directly affects company value, financial stability, and future growth opportunities. It is not just a choice between debt and equity, but the art of balancing risks and opportunities with long-term business goals in mind.

When making decisions about raising capital, I am guided by the following key criteria:

- Cost: Equity financing is traditionally considered “more expensive” than Debt financing, because dividends are not tax-deductible, and investors demand a higher risk premium. However, optimizing the capital structure (the debt-to-equity ratio) allows for maximizing company value by using financial leverage while maintaining control. My expertise lies in finding the balance that ensures the lowest Weighted Average Cost of Capital (WACC) and enhances business value.

- Maturity (Term): Long-term financing is usually more expensive due to the risk premium, but it provides greater financial stability and predictability, allowing for the financing of long-term assets and investment projects without the risk of sudden funding withdrawal. I always strive for Maturity Matching — aligning financing terms with project lifecycles and asset lifecycles — to minimize liquidity risks and ensure uninterrupted operations.

- Term Structure of Interest Rates: Although short-term loans often seem cheaper, using them to finance long-term needs can lead to a liquidity crisis and increased refinancing risks (Rollover Risk). My approach involves a deep analysis of market trends and forecasting rate changes to protect the company from unforeseen costs and ensure the stability of the debt portfolio.

- Financial Leverage and Risk: Using debt financing (Financial Leverage) can significantly boost returns for owners (ROE), but excessive leverage increases financial risks and the cost of borrowing. My role is to carefully assess the level of acceptable risk by analyzing the company’s debt service capacity and its resilience to adverse market conditions. This allows for making informed decisions that do not jeopardize business stability.

- Access to Funding and Market Relationships: Not all financing sources are equally available to every company. My years of practice involve building and maintaining trust-based relationships with banks, investment funds, and private investors. This ensures access to a wide range of financial instruments and the ability to choose the most favorable terms, even in difficult market situations. I actively use financial analysis and negotiation skills to successfully raise the necessary capital.

Conclusion

Neglecting Balance Sheet analysis significantly increases the risk of corporate bankruptcy due to uncontrolled debt growth and liquidity shortages.

Furthermore, a weak Balance Sheet can complicate raising investments and loans, as investors and creditors use it to assess the company’s financial health.

The Balance Sheet is an indispensable tool for effective business management and ensuring its long-term stability. It shows the financial position at a specific date and serves as the foundation for strategic planning, liquidity and solvency control, capital structure analysis, and sound investment decisions.

Regular and in-depth analysis of the Balance Sheet, including the calculation of key ratios, allows for timely risk detection and the use of insights for company growth and development. View the Balance Sheet not as an accounting formality, but as the foundation of financial strength and long-term prosperity.