Analyzing a Real-World Manufacturing Case Study

The Situation

A company sells its products (coated rolled steel) in Ukraine and exports to several European countries.

In a month of low demand, when the company has idle production capacity, it received a request from a buyer in a new country. They want to purchase 60 tons of coated steel at a price of 21,000 UAH/t.

The regular selling price for this product is 22,000 UAH/t. The company has no prior orders from this country.

However, according to the Sales Department, even a one-time sale would introduce the new market to the product’s quality and could potentially allow for future entry into this market at regular prices.

The Dilemma: Should the company accept this offer?

Let’s look at the budget information for this month

Table 1: Monthly Budget Data

| Item | Total, UAH | Per 1 ton, UAH |

| Direct Materials | 95,480,000 | 17,050 |

| Variable Manufacturing Overheads | 8,736,000 | 1,560 |

| Fixed Manufacturing Overheads | 9,240,000 | 1,650 |

| Variable Labor (Wages) | 1,624,000 | 290 |

| Fixed Labor (Salaries) | 3,472,000 | 620 |

| Total Production Cost | 118,552,000 | 21,170 |

| Revenue | 123,200,000 | 22,000 |

| Gross Profit | 4,648,000 | 830 |

Analysis

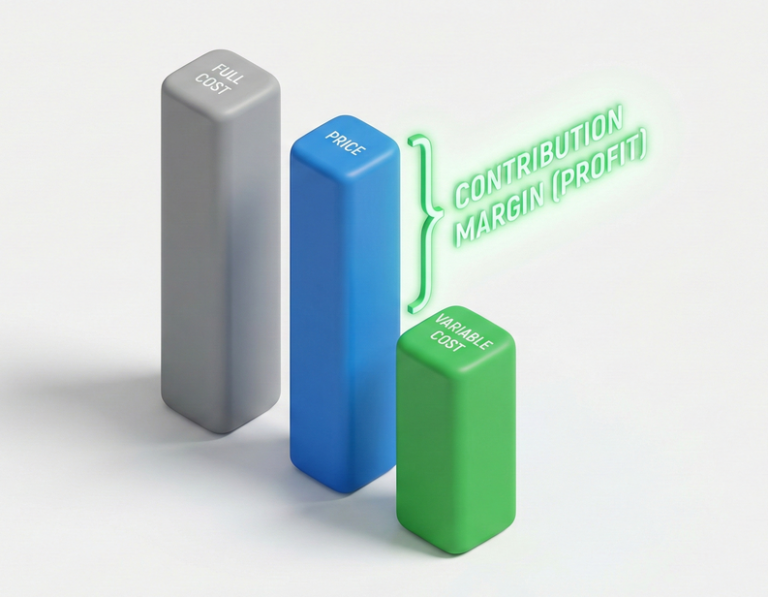

At first glance, it seems the order should be rejected because the offered price of 21,000 UAH/t is lower than the full production cost of 21,170 UAH/t.

However, a closer examination of the costs reveals that certain production expenses will remain unchanged regardless of whether we accept this order or not.

Table 2 presents the change in revenue and costs if the order is accepted. This highlights which information is relevant for this decision.

Table 2: Incremental Analysis

| Item | Reject Order, UAH | Accept Order, UAH | Difference (Relevant Cash Flow), UAH |

| Direct Materials | 95,480,000 | 96,503,000 | 1,023,000 |

| Variable Mfg Overheads | 8,736,000 | 8,829,600 | 93,600 |

| Fixed Mfg Overheads | 9,240,000 | 9,240,000 | 0 |

| Variable Labor | 1,624,000 | 1,641,400 | 17,400 |

| Fixed Labor | 3,472,000 | 3,472,000 | 0 |

| Total Production Cost | 118,552,000 | 119,686,000 | 1,134,000 |

| Revenue | 123,200,000 | 124,460,000 | 1,260,000 |

| Gross Profit | 4,648,000 | 4,774,000 | 126,000 |

As we can see, in this situation, selling a batch of 60 tons at a price below the full production cost will actually generate 126,000 UAH of additional profit for the company.

However, before making a final decision, it is crucial to consider a number of qualitative factors:

- Will selling at a lower price affect future market prices and relationships with existing clients (Cannibalization risk)?

- Will this order prevent the company from accepting more profitable offers during the production period (Opportunity cost)?

- Is this the best use of the company’s free resources?

Strategic Recommendation

1. Accept the order, but with conditions:

- Strict Volume Limit: Define the contract clearly as a “one-time supply” or “trial batch.”

- Prepayment: Require full or partial prepayment to minimize non-payment risks in a new market.

- Parallel Search: Continue looking for alternative, higher-margin orders.

2. Monitor Consequences:

- Track competitor reactions over the next 3 months.

- Evaluate the conversion rate into permanent contracts at regular prices after 6 months.

As a CFO, I always emphasize the importance of conducting such deep analysis. A correct understanding of cost relevance allows you to leverage idle capacity, generate additional margin, and even open new markets, turning seemingly “loss-making” orders into a source of profit.

You can read about how to make decisions in other situations in my articles: Costing Traps (Part 1), (Part 2), (Part 3), as well as Weighted Average Cost Is a Fiction and other articles on this site.